This week in crypto: Altcoin Breakout, Record ETF Flows & DeFi-Fintech Convergence

Weekly Web3 Analytics Digest | July 15, 2025

Through The Signal, I deliver weekly curated perspectives that support builders, VCs and analysts when decisions matter most, uncovering meaningful patterns in onchain metrics and industry trends that often get overlooked in the chaotic stream of crypto information.

TL;DR:

Altcoin rotation accelerates as Bitcoin dominance breaks down (-1.56% to 64.26%) with altcoins surging +17.30% and record ETF inflows of $2.7B signaling institutional capital cascading beyond BTC into broader crypto markets, creating a 4-8 week optimal window for token launches before typical exhaustion patterns emerge.

Coinbase shatters $100B valuation as Bitcoin hits $120K while Pump.fun's token sale raises $448.5M in 12 minutes at $4B FDV, demonstrating how established crypto infrastructure plays and novel tokenomics models are both capturing massive institutional and retail demand in the current rally.

DeFi infrastructure becomes fintech backend of choice as Revolut selects Morpho over Aave for yield products despite 6x TVL difference ($5B vs $29.3B), highlighting how permissionless vault creation and enterprise tooling trump raw liquidity when major fintechs need rapid deployment capabilities.

[Data captured: July 15, 2025 at 11:10 GMT +2]

Key Trends This Week:

Altcoin Breakout Signals Rotation Beginning: Altcoin market cap surged +17.30% to $271.82B, dramatically outperforming BTC's +8.04% gain while Bitcoin dominance declined -1.56% to 64.26%, marking the first significant capital rotation from BTC to alts after weeks of consolidation and suggesting the start of an altseason cycle.

Record ETF Flows Drive Institutional FOMO: Bitcoin ETF inflows exploded to $2,717.5M (+253.15% WoW), the highest single-week inflow on record and contributing to an 8-week cumulative of $10.6B, signaling aggressive institutional accumulation that's now cascading into broader crypto markets as evidenced by surging DEX (+35.40%) and perpetuals (+48.09%) volumes.

Market Structure Confirms Sustainable Rally: Despite explosive gains, sentiment remains at 73 (Greed) without reaching extremes, while stablecoin supply expanded +1.12% to $258.35B and trading volumes across all venues sit 15-16% above 4-week averages, indicating healthy market participation with room for continuation before exhaustion signals emerge.

What This Means For Projects:

Execute Launches Within 4-8 Week Window: The confluence of declining BTC dominance (64.26%), surging altcoin performance (+17.30%), and non-extreme sentiment (73/100) creates optimal conditions for token launches and fundraising, but historical patterns suggest this favorable environment typically lasts 4-8 weeks before leverage and euphoria mark local tops.

Prioritize High-Activity Chain Deployment: With Solana processing $69.3B in DEX volume (+27%) and select L2s showing outsized fee generation despite lower TVL, projects could abandon traditional Ethereum-first strategies in favor of deploying where actual trading activity and fee capture concentrate, as institutional capital tends to follow liquidity rather than brand recognition.

Markets

2025-07-14 –Coinbase Rockets Past $100B Valuation as Bitcoin Smashes Through $120K

Coinbase shares finished Monday at a record $394.01, propelling the exchange’s market capitalization above $100 billion for the first time just as bitcoin sprinted past $120 000 to new all‑time highs. The landmark caps a roughly 50% month‑long rally that analysts attribute to booming BTC demand, Coinbase’s recent inclusion in the S&P 500, and a friendlier U.S. regulatory outlook, cementing the stock’s status as Wall Street’s prime proxy for the crypto boom.2025-07-14 – Pump.fun Token Sale Sells Out in 12 Minutes, Raising $448.5M

Pump.fun's ICO hit its $4B FDV cap instantly, with 10,260 buyers scooping up $448.5M worth of PUMP in just 12 minutes. Nearly 24,000 wallets KYC'd for the sale, highlighting massive demand for one of Solana's biggest token launches. Tokens will be distributed within 72 hours, initially non-transferable.

Innovations

2025-07-14 – Revolut Taps Morpho to Power DeFi Yield for Millions of Users

Revolut has selected Morpho as its DeFi backend, marking a major step toward bringing Ethereum-native yield products to its global user base. The British fintech, celebrating its 10th anniversary, will offer Morpho-powered crypto savings features as a modern alternative to traditional bank accounts. The move also hints at a broader trend of major fintechs bootstrapping through existing EVM deployments before launching their own L2 infrastructure.

2025-07-14 – Binance Wallet Unveils Pump.fun‑Inspired Bonding‑Curve TGEs With Four.Meme

Binance is embedding Pump.fun‑style bonding‑curve token launches in its Wallet, starting July 15 with Four.Meme. Prices rise with demand, BNB buys stay locked and tokens remain non‑transferable until the sale ends, though holders can cash out early by selling back into the curve.

Layer 1 Blockchains Hit Multi-Year Highs as Stablecoin and RWA Adoption Accelerates

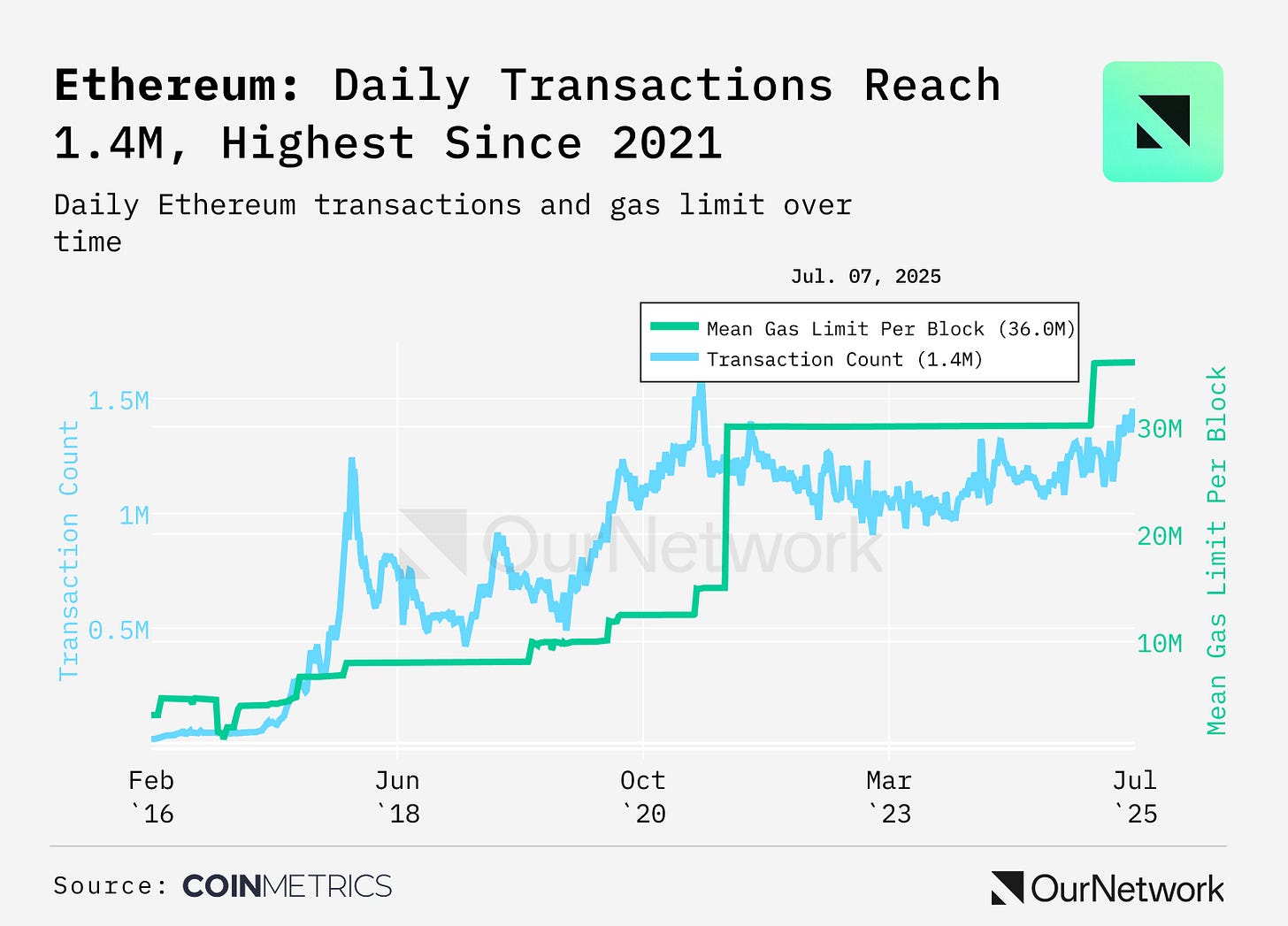

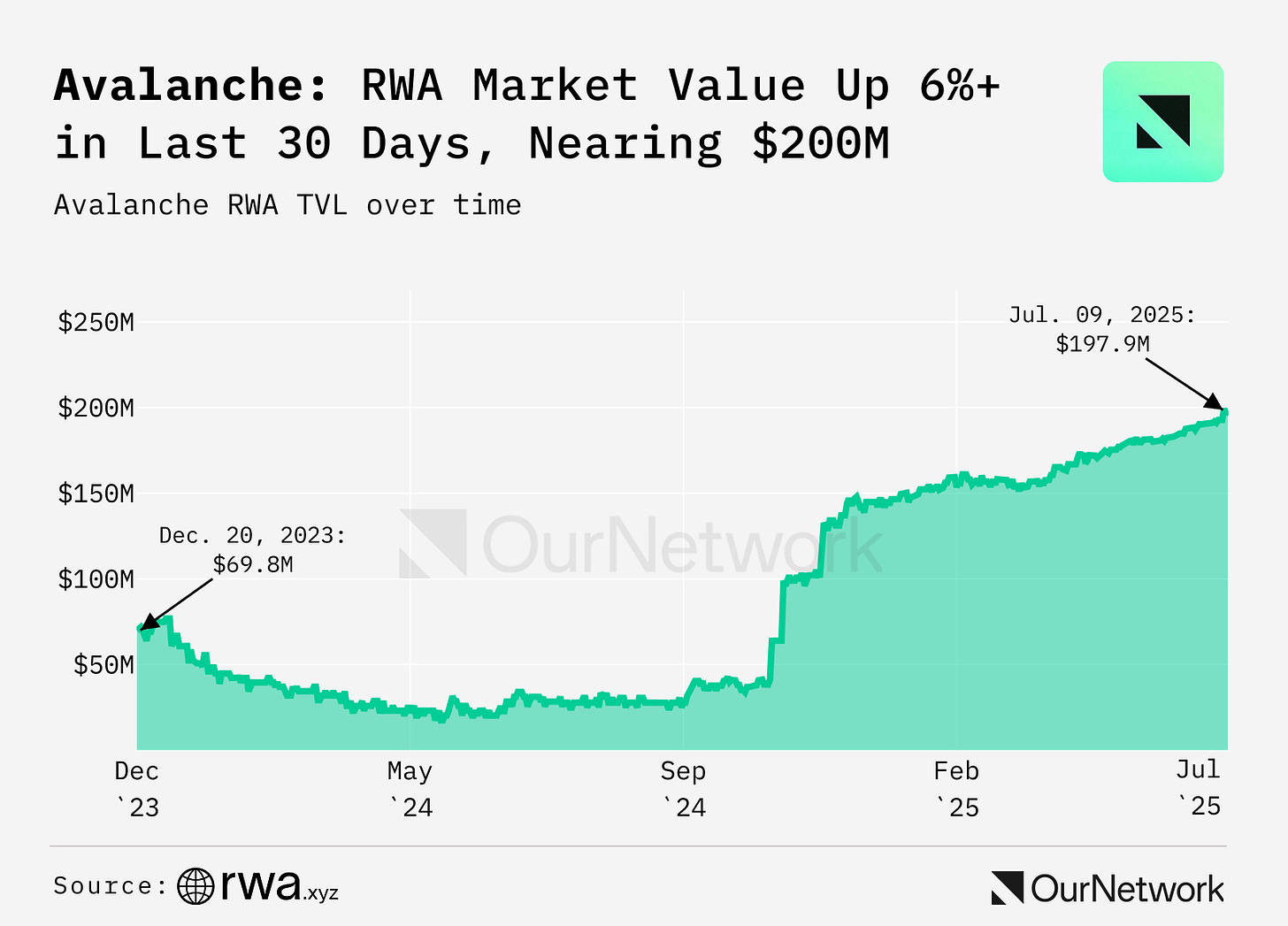

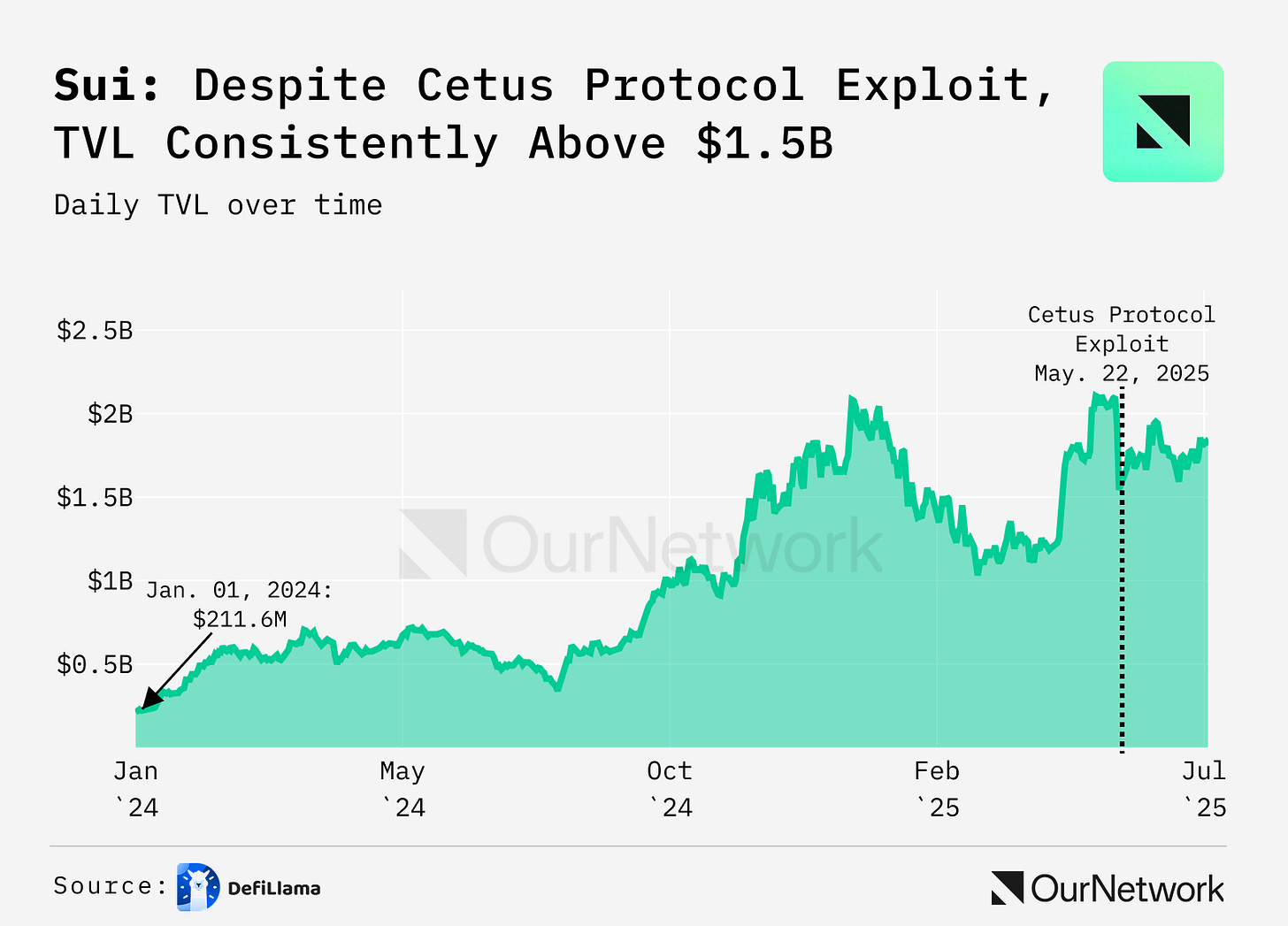

OurNetwork's latest Layer 1 analysis reveals a sector-wide resurgence driven by fundamental utility rather than speculation. Ethereum mainnet transactions reached 1.4M, the highest since November 2021, while processing a record $30B in daily stablecoin volumes. This momentum extends across major chains: Avalanche's subnet architecture enabled explosive growth to 14M+ daily transactions, Sui rebounded from a $220M exploit to reclaim $1.8B TVL, and Aptos surpassed 3B lifetime transactions while becoming a top-3 RWA chain. These developments signal Layer 1s are successfully scaling infrastructure to support real-world financial applications.

Source: Coin Metrics

Ethereum: Mainnet transactions reached 1.4M, the highest level since November 2021, while stablecoin transfer volumes averaged a record $30B with 55% of total stablecoin supply residing on Ethereum. -Tanay (Research Analyst, CoinMetrics)

Source: RWA.xyz

Avalanche: The network now hosts $192.8M in tokenized RWAs - excluding stablecoins (6% growth over 30 days) and daily transactions surged from 3M to over 14M in June through subnet architecture, while gas fees plummeted to near-zero levels. -yasmin (Crypto Analyst)

Source: DefiLlama

Sui: Despite a $220M Cetus Protocol exploit, Sui's DeFi ecosystem reclaimed $1.8B TVL and achieved 255.4% year-over-year stablecoin growth to over $1.1B, while daily active users grew 70% to 978k. - Biff Buster (Contributor, OurNetwork)

Podcast of the Week

Are Tokenized Stocks Real? - Bankless

Bankless hosts Gabriel Otte, founder of Dinari, to discuss how his company secured the first broker-dealer license for tokenized public shares, the regulatory hurdles that have delayed tokenized stocks, and whether true DeFi composability is finally possible for equities trading.

Chart of the Week

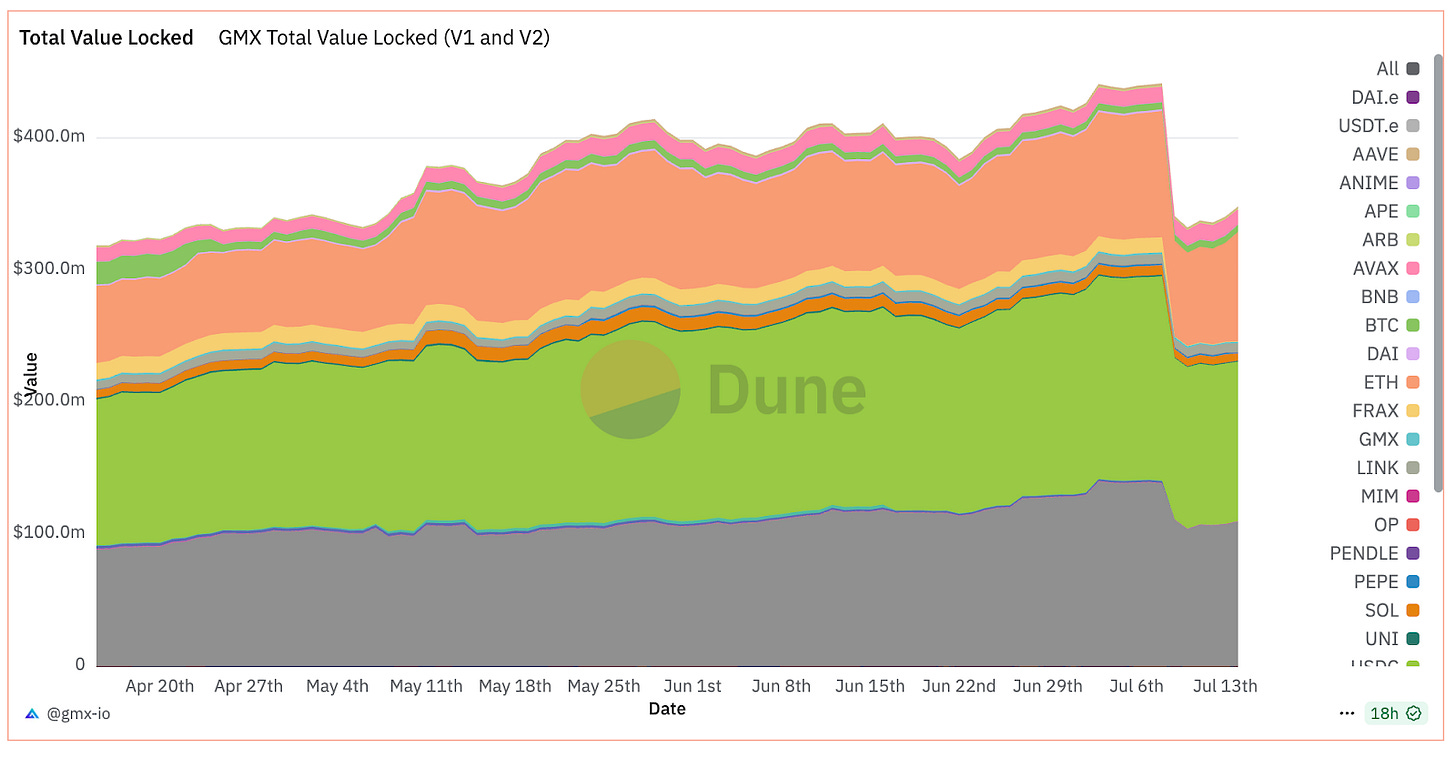

Source: Dune - GMX

GMX's TVL dropped sharply from $441M to $329M following the July 9th exploit of its V1 protocol on Arbitrum and Avalanche, representing a 25% decline as users withdrew USDC, WBTC, and ETH. The chart shows TVL has since stabilized around $330M levels, suggesting the market views this as a V1-specific issue rather than a systemic platform risk, especially given that GMX V2 and the GMX token remained unaffected throughout the incident.

Looking Ahead

Morpho is gaining momentum in the "DeFi as a backend" race despite Aave's significantly larger scale (Aave: $29.3B TVL vs Morpho: $5.0B TVL) because it was purpose-built for fintech integration rather than retrofitted for it. While Aave remains the incumbent with deeper liquidity, Morpho's key advantages lie in its permissionless vault creation and immutable core contracts, allowing partners like Coinbase and Revolut to launch custom products in days rather than weeks, without governance dependencies or upgrade risks that could break their consumer applications. The protocol's enterprise-focused tooling, including REST APIs and TypeScript SDKs designed specifically for non-crypto developers, has proven decisive in winning major fintech partnerships where user experience and regulatory compliance matter more than raw TVL.

Aave v4, expected in Q3 2025, represents a strategic pivot toward Morpho's aggregated model with its Unified Cross-Chain Liquidity Layer and Smart Accounts/Vaults that will enable isolated products without fragmenting liquidity. However, Morpho maintains critical structural advantages even as the roadmaps converge: its governance-free vault deployment versus Aave's continued reliance on DAO approval for new assets and modules, its current market availability while Aave v4 remains 6-12 months out, and its established fintech-first brand perception. As one Revolut insider noted, they chose Morpho over Aave "because of team quality & ability to spin up custom vaults", highlighting how execution speed and developer experience often trump market size in the fast-moving fintech integration space. The real test will come in 2026 when Aave v4's cross-chain liquidity layer matures, potentially combining Aave's scale with Morpho-like flexibility.

Until next Tuesday,

Vincent Charles

Did a friend forward this to you? Subscribe here to receive The Signal directly.