THE SIGNAL: July 22, 2025

Regulatory Breakthrough, Altcoin Season & Layer 2 Enterprise Adoption

This week in The Signal: Regulatory Breakthrough, Altcoin Season & Layer 2 Enterprise Adoption

Weekly Web3 Analytics Digest | July 22, 2025

Through The Signal, I deliver weekly curated perspectives that support builders, VCs and analysts when decisions matter most, uncovering meaningful patterns in onchain metrics and industry trends that often get overlooked in the chaotic stream of crypto information.

TL;DR:

Crypto achieves historic institutional legitimacy as Trump signs GENIUS Act into law with bipartisan support while investment funds record $4.39B weekly inflows: the highest ever, with Ethereum leading at $2.12B, signaling a fundamental shift from speculative to regulated institutional adoption.

Altcoin season confirmation drives capital rotation frenzy with altcoin market cap surging +30.18% over 4 weeks as Bitcoin dominance crashes -5.47% to 60.98%, while trading volumes explode +43.99% to $139.40B amid $400M Ethereum institutional inflows, creating optimal conditions for high-beta alt momentum.

Layer 2 networks achieve mainstream readiness as 102 live chains collectively process over 3,500 transactions per second with fees under $0.0001, while major corporations like Robinhood choose Arbitrum for production builds and stablecoin usage hits 1M+ daily transactions across L2s, proving the infrastructure has evolved from experimental to enterprise-grade.

[Data captured: July 22, 2025 at 17:25 GMT +2]

Key Trends This Week:

Altcoin Breakout Confirms Rotation: Altcoin market cap surged +12.14% to $304.82B, marking 3rd consecutive week of gains (+30.18% over 4 weeks) while Bitcoin dominance plummeted -5.47% to 60.98%, the sharpest weekly decline in our dataset, confirming aggressive capital rotation from BTC to alts as institutional Ethereum inflows reached $400M, signaling a structural shift in market dynamics.

Trading Activity Explosion Signals New Market Phase: Perpetuals volume skyrocketed +43.99% to $139.40B (52.77% above 4-week average) while DEX volumes rose +13.21% to $128.78B, with combined trading activity reaching multi-month highs as stablecoin supply maintained steady expansion +1.72% to $262.47B, continuing its consistent growth trajectory (+8.16% over 11 weeks) and providing sustained liquidity inflows to support the current rally.

Institutional Demand Sustains Despite BTC Consolidation: Bitcoin ETF flows maintained robust $2.39B inflows (6th consecutive positive week) supporting BTC's 4-week gain of +12.44% despite modest -0.66% weekly decline, while Fear & Greed Index holds at 72 (Greed) in a "positive but not overheated" range, creating ideal conditions for continued momentum without immediate risk of market exhaustion.

What This Means For Projects:

Execute Alt Season Strategies Now: With BTC dominance breaking down -5.47% to 60.98% and altcoin market cap surging +30.18% over 4 weeks alongside $400M Ethereum institutional inflows, projects should accelerate token launches, liquidity events, and marketing campaigns during this confirmed rotation window before dominance stabilizes - conditions are primed for momentum to continue in high-beta alts and active ecosystems.

Deploy Capital Before Sentiment Peaks: Market sentiment at 72 (Greed) remains below extreme levels while trading volumes surge 52.77% above averages and stablecoin expansion reverses multi-month decline, creating optimal fundraising conditions: projects should deploy treasury reserves for growth initiatives and secure partnerships now, as this setup typically precedes a strong leg up that could quickly shift sentiment to overheated territory.

Markets

2025-07-21 – Trump Signs GENIUS Act Into Law

President Trump signed the GENIUS Act into law at a White House ceremony packed with crypto executives, including leaders from Coinbase, Tether, Circle, and Gemini, marking the first major crypto legislation to become U.S. policy with overwhelming bipartisan support (House 308-122, Senate 68-30). Trump, who has declared himself the "crypto president," called the signing a "massive validation" for an industry that was "mocked and dismissed" just 18 months ago.2025-07-22 – Crypto Investment Funds See Record $4.4B Weekly Inflows

Crypto investment products saw record inflows of $4.39 billion last week, the highest weekly figure ever recorded by CoinShares, pushing 2025's year-to-date total to $27 billion. Ethereum led the increase with $2.12 billion of inflows, its 13th straight week of gains, outpacing Bitcoin's $2.2 billion and setting a new personal weekly record. U.S. funds dominated with $4.36 billion in flows, while altcoins like Solana, XRP, and Sui also saw notable inflows, underscoring widening investor risk appetite across the sector.

Innovations

2025-07-21 – Tether to Create New Stablecoin to Comply with GENIUS

Tether CEO Paulo Ardoino announced plans to comply with the newly-passed GENIUS Act as a foreign issuer while developing a separate US-specific institutional stablecoin. They plan to leverage the company's $13 billion in annual profits to meet new requirements and hire a Big Four auditor, representing a dramatic reversal from Tether's previous avoidance of US markets.

2025-07-22 – Aave Greenlights White-Label Lending Platform on Ink L2

Aave DAO has approved the Kraken-backed Ink Foundation to launch a rebranded, white-label version of Aave V3 on the Ink Layer 2 chain. The vote passed overwhelmingly, with 99.8% in favor, enabling Aave to enter the institutional lending space while Ink commits to driving over $250 million in initial liquidity through liquidity mining programs. In return, Aave will receive at least 5% of the interest on the borrow volume as revenue and gain exclusivity over Ink's lending integrations for 12 months.

Layer 2 Infrastructure Matures as Transaction Volumes Surge and Corporate Adoption Accelerates

OurNetwork's latest Layer 2 analysis reveals an ecosystem reaching institutional-grade maturity with 102 live networks processing over 3,500 collective transactions per second at sub-cent fees. The sector now secures over $12.5B in stablecoins while achieving record-breaking 1M+ daily stablecoin transactions, attracting major corporate builders like Robinhood to Arbitrum. Meanwhile, consumer-focused chains like Abstract are pioneering seamless experiences with 2.7M smart wallets executing 53M account abstraction transactions, demonstrating Layer 2s have evolved into production-ready platforms supporting both institutional finance and consumer applications.

Source: growthepie

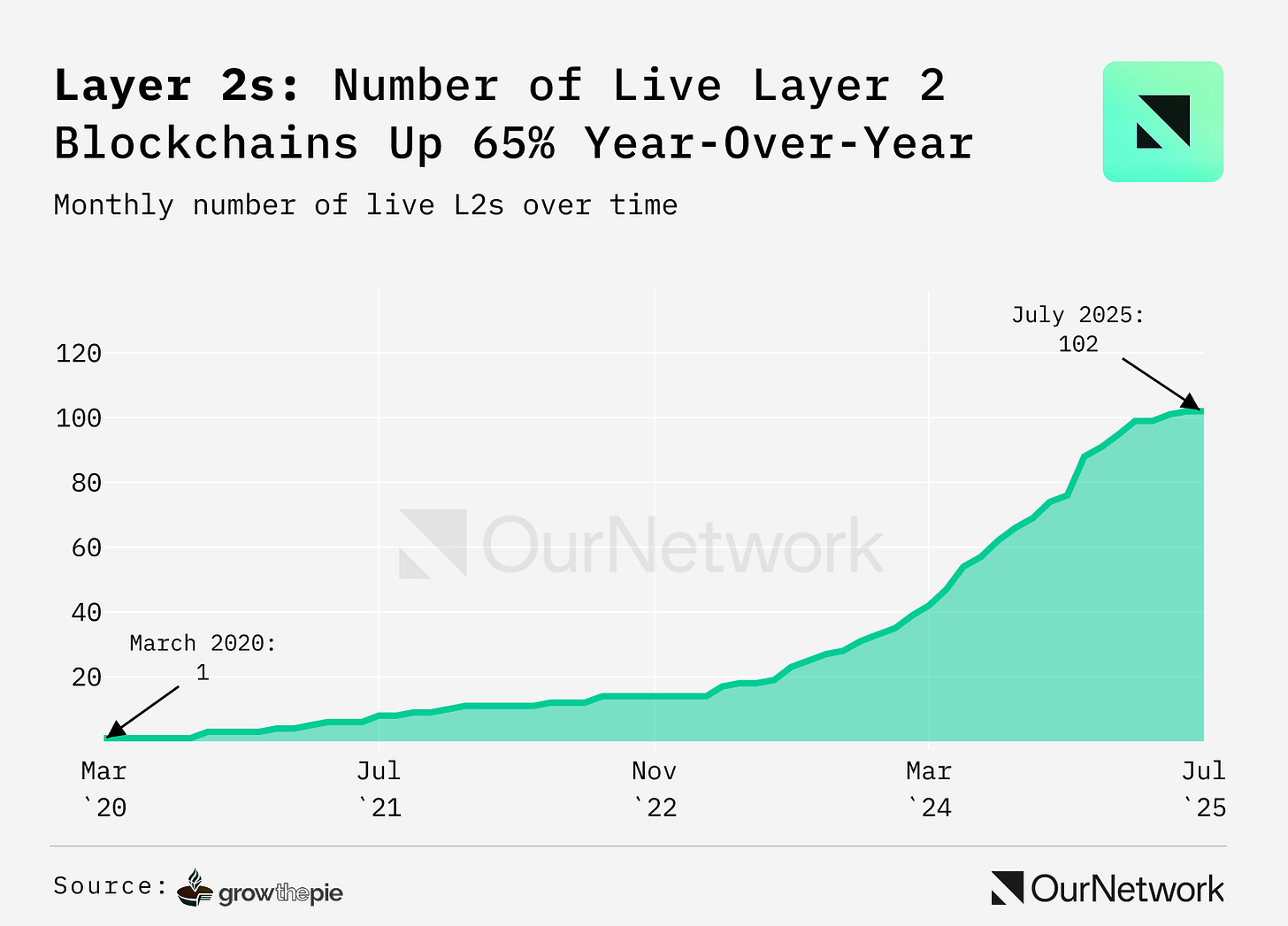

Layer 2 Ecosystem: There are currently 102 Layer 2s live, up 65% from last year, with the Ethereum ecosystem collectively hitting over 3,500 transactions per second and sub-cent fees as low as <$0.0001 - growthepie

Source: growthepie

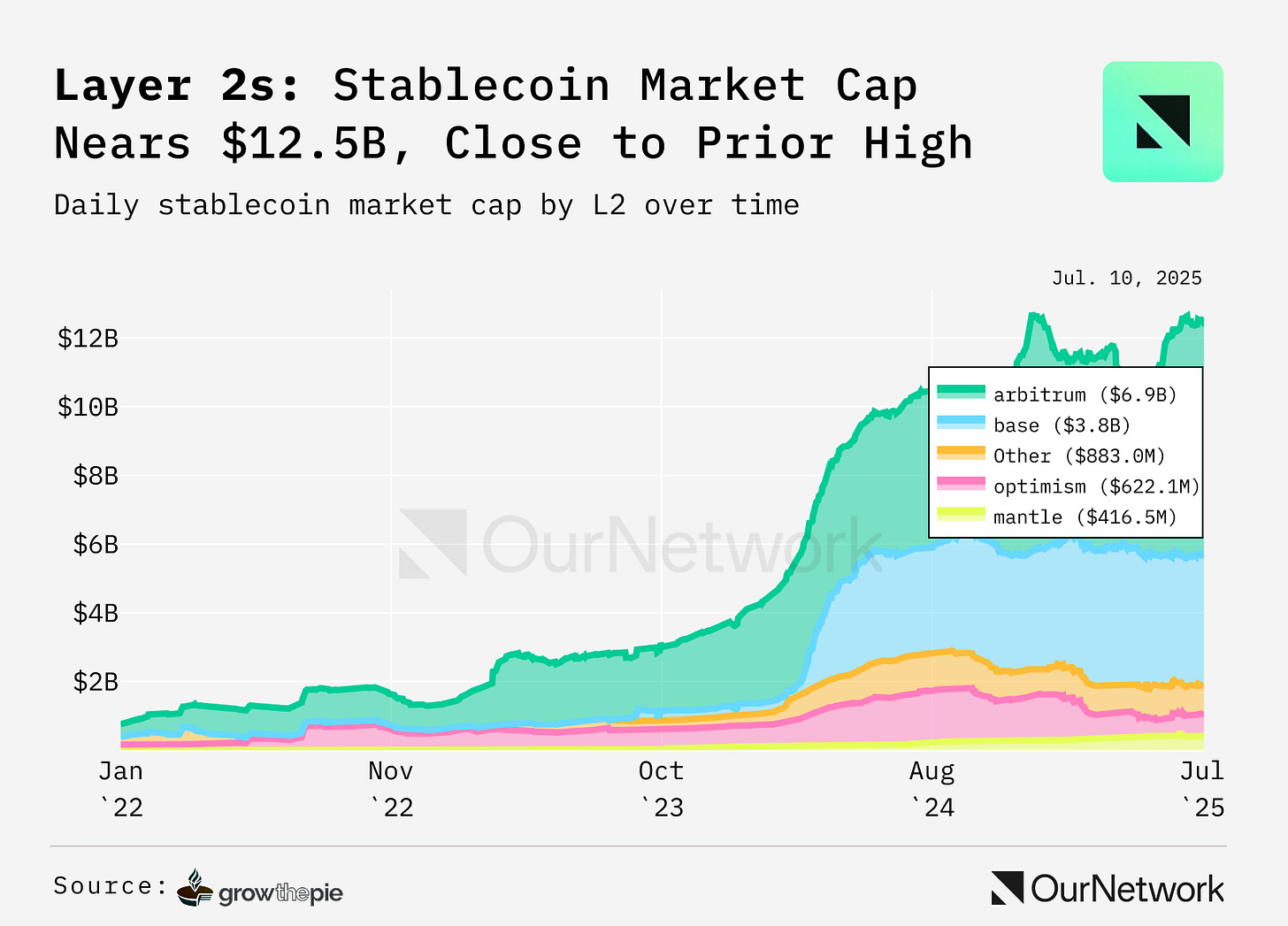

Layer 2 Stablecoins: L2s secure over $12.5B in stablecoins (8.8% of Ethereum's stablecoin supply) and are experiencing record-breaking daily stablecoin transactions reaching over 1M daily - growthepie

Podcast of the Week

The Data Behind DeFi’s Biggest Upgrade - Indexed Podcast

Indexed Podcast hosts Jackie, Head of Data Science at Uniswap Foundation, and Grace from Uniswap's Data team to explore the data-driven insights behind Uniswap V4's launch and ecosystem evolution. The discussion covers V4's unique hook system and liquidity management innovations like Bunni, new TVL measurement challenges in concentrated liquidity environments, arbitrage flow patterns, Unichain's adoption metrics, spam mitigation strategies for L2s, and the growing integration of smart wallets within the Uniswap ecosystem.

Chart of the Week

Source: Dune - Seoul

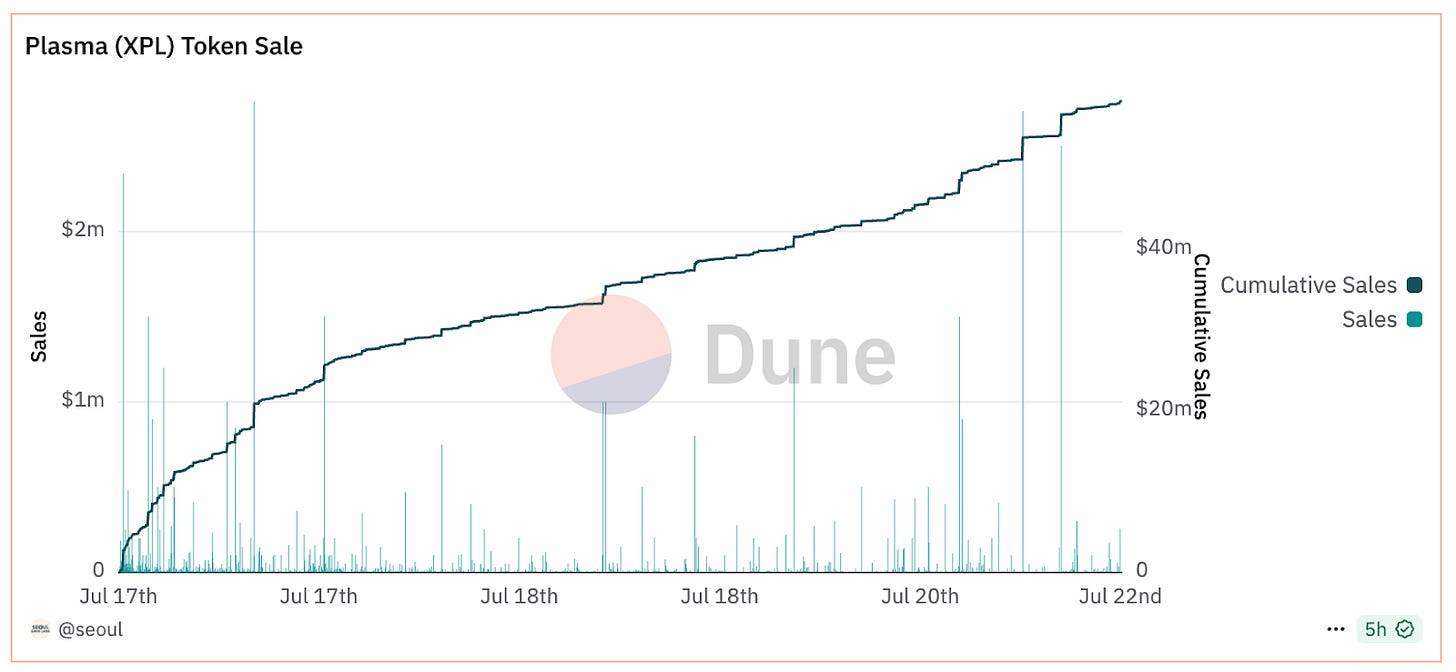

Plasma's $XPL token sale has raised $58.32M in cumulative sales since launching on July 17th, following a deposit phase that attracted over $1B in stablecoins from 2,930 addresses. The chart shows steady momentum with sales climbing consistently over the 5-day period, demonstrating strong demand for the L1 blockchain purpose-built for stablecoins at its $500M fully diluted valuation, with participants committing an average of $33K+ per user.

Looking Ahead

The GENIUS Act's signing has crystallized a fundamental divide in crypto's regulatory future, with major stablecoin issuers like Circle and Coinbase celebrating what they view as a "transformative" legitimization of digital dollars, while smaller DeFi protocols face an existential challenge. Circle CEO Jeremy Allaire's declaration that the act "enshrines Circle's way of doing business into law" isn't hyperbole. The legislation's 1:1 reserve requirements, federal licensing mandates, and monthly audit obligations heavily favor established players who already operate under these constraints. Meanwhile, algorithmic stablecoins like MakerDAO's DAI may struggle to comply due to their decentralized, non-collateralized backing mechanisms, potentially forcing a migration of DeFi innovation offshore or into regulatory gray zones. Wall Street's immediate pivot is telling: JPMorgan's Jamie Dimon, despite his crypto skepticism, acknowledged the inevitability with "we're going to be involved in both JPMorgan deposit coin and stablecoins" while Citigroup's Jane Fraser enthusiastically announced plans for a "Citi stablecoin," signaling that traditional finance views this as an opportunity to capture the $267 billion stablecoin market.

The real battleground ahead isn't just regulatory compliance: it's whether the GENIUS Act accelerates or stifles blockchain innovation. Treasury Secretary Scott Bessent's prediction of a $3.7 trillion stablecoin market by 2030 assumes the current duopoly of USDC and USDT will expand into a competitive ecosystem, but critics warn that stringent federal requirements could create "monopolies or oligopolies" among tech giants and banks. The ultimate test will be whether the act's consumer protection benefits: federal oversight, reserve transparency, and redemption guarantees prove worth the potential innovation trade-offs as the global stablecoin landscape reshapes around American regulatory leadership.

Until next Tuesday,

Vincent Charles

Did a friend forward this to you? Subscribe here to receive The Signal directly.

With the GENIUS act in play, we are still in Day 1 of crypto adoption.

Keep the signal flowing Vincent...