This week in The Signal: Healthy Correction & Capital Selectivity

Weekly Web3 Analytics Digest | June 03, 2025

Through The Signal, I deliver weekly curated perspectives that support builders and analysts when decisions matter most. I uncover meaningful patterns in on-chain metrics and industry trends that often get overlooked in the chaotic stream of crypto information.

This Week's Top Signals:

Bitcoin's 8-week rally (+41.5%) concludes with first pullback as institutional profit-taking begins, creating market-wide selectivity with divergent performance across altcoins while leveraged speculation (perpetuals -22.17%) unwinds during healthy retest phase

Restaking sector achieves 1,000x growth milestone reaching $20B TVL from sub-$20M two years ago, with Ether.fi maintaining $6.8B and Jito generating $36M annualized revenue, establishing restaking as DeFi's fastest-growing primitive

OpenSea launches OS2 with $SEA token rewards across 19 chains while Circle files $5B+ NYSE IPO, signaling major infrastructure players preparing for next growth phase as high-leverage speculation gets washed out (trader loses $1.25B position on Hyperliquid)

[Data captured: June 03, 2025 at 8:20 GMT +2]

Key Trends This Week:

8-Week Bitcoin Rally Ends with Healthy Correction: Bitcoin's first pullback (-3.69% to $105,433) after an unprecedented 8-week rally from $74,500 (+41.5% total gains) coincides with ETF outflows turning negative (-$144.8M) for the first time since institutional accumulation began, signaling profit-taking at cycle highs.

Altcoin Weakness Intensifies Risk-Off Sentiment: Altcoin market cap declined -6.21% (excluding ETH) versus BTC's -3.69%, with perpetuals volume down -22.17% while DEX volumes held steady (+1.47%), indicating leveraged speculation unwinding while spot accumulation continues through patient capital.

Market Structure Remains Constructive Despite Pullback: BTC dominance held stable (64.09%, -0.38%) and stablecoin supply grew (+0.38% to $248.41B) even during price weakness, suggesting this represents healthy consolidation rather than trend reversal as Fear & Greed Index cooled from 74 to 58.

What This Means For Projects:

Retest Phase Creates Strategic Window: This week's pullback appears to be a retest of prior highs rather than the start of a broad reversal, with institutional ETF flows turning negative after 5 weeks of inflows indicating planned profit-taking rather than panic, suggesting a 4-6 week opportunity window for quality projects before institutional appetite likely resumes.

Selective Quality Bias Emerging: Despite broad altcoin weakness (-6.21%), select names like Quant (+18.88%) and DeXe (+18.56%) showed strong resilience, while stable DEX volumes indicate patient capital is discriminating between fundamentally strong projects and speculative plays during this consolidation phase.

Altcoin Rotation Setup Building: BTC dominance flattening suggests more meaningful rotation into altcoins could emerge as the current -6.21% decline creates oversold conditions, particularly favoring projects with strong on-chain metrics and usage rather than narrative-driven tokens.

Markets

2025-05-28 – Circle Files for NYSE IPO at $5B+ Valuation

Circle Internet Group, issuer of USDC stablecoin, filed for NYSE IPO under ticker "CRCL" targeting $24-26 per share to raise ~$250 million at over $5 billion valuation. Major banks J.P. Morgan, Citigroup, and Goldman Sachs are leading the offering after Circle's failed 2021 SPAC attempt and recent exploration of potential sales to Coinbase or Ripple.2025-06-02 – High-Profile Trader Loses $1.25B Position on Hyperliquid

James Wynn, known for billion-dollar bets on Hyperliquid, was fully liquidated after his $1.25 billion BTC long position incurred a $37 million loss when Bitcoin dropped below $105,000. Despite briefly holding $85 million in unrealized gains cycling through memecoins like PEPE, TRUMP, and FARTCOIN, Wynn ended the month with just $23 remaining in his account.

Innovations

2025-06-02 – OpenSea Launches OS2 Platform with $SEA Token Rewards Program

OpenSea officially launched OS2 as its default platform supporting tokens across 19 chains, introducing "Voyages" XP rewards system that will determine upcoming $SEA token distribution alongside past trading history. The platform implemented anti-botting measures and stated several major innovations must be completed before token generation, though no specific timeline was provided.

2025-05-30 – EulerSwap Combines Uniswap v4 Hooks with Lending Infrastructure

Euler launched as a new DEX integrating Uniswap v4's hook architecture with Euler's lending platform, allowing LPs to earn swap fees, lending yield, and use positions as collateral simultaneously. The platform targets DAOs and sophisticated market makers with features like just-in-time liquidity, custom AMM curves, and isolated LP pools for enhanced capital efficiency.

Restaking: Ether.fi and Jito Drive 1,000x Sector Growth

OurNetwork's latest edition examines the restaking ecosystem during a period of explosive growth. Restaking has transformed from an idea with less than $20M in total value locked less than two years ago to a space with over $20B, representing over 1,000-fold growth according to DefiLlama data.

Source: Chaos Labs

Ether.fi: Ether.fi maintained its position as DeFi's fourth largest protocol with $6.8B TVL, seeing weETH/eETH supply grow by 154K ETH over the past month with 27,749 ETH TVL across 10+ chains and Aave dominating usage with 1.86M ETH at 88% utilization. - Craig Le Riche

Source: Dune - @jito

Jito: Jito's TipRouter NCN has distributed 3,607 JitoSOL (~$682k) to stakers and operators since February launch while generating $36M annualized revenue for Jito DAO through 2.7% of all Solana tips worth over $1B annually. - Hayden Tsutsui

Podcast of the Week

Inside Dune with Mats Olsen - Decentralised.co

Mats Olsen, CTO and co-founder of Dune, discusses how the platform evolved from a 2018 Oslo startup to a $70M Series B analytics infrastructure solving real-time blockchain data access for crypto teams. The conversation covers Dune's community-driven approach, their strategic acquisition of smlXL for real-time indexing, and how they're positioning to power the applications that will bring crypto to mainstream users.

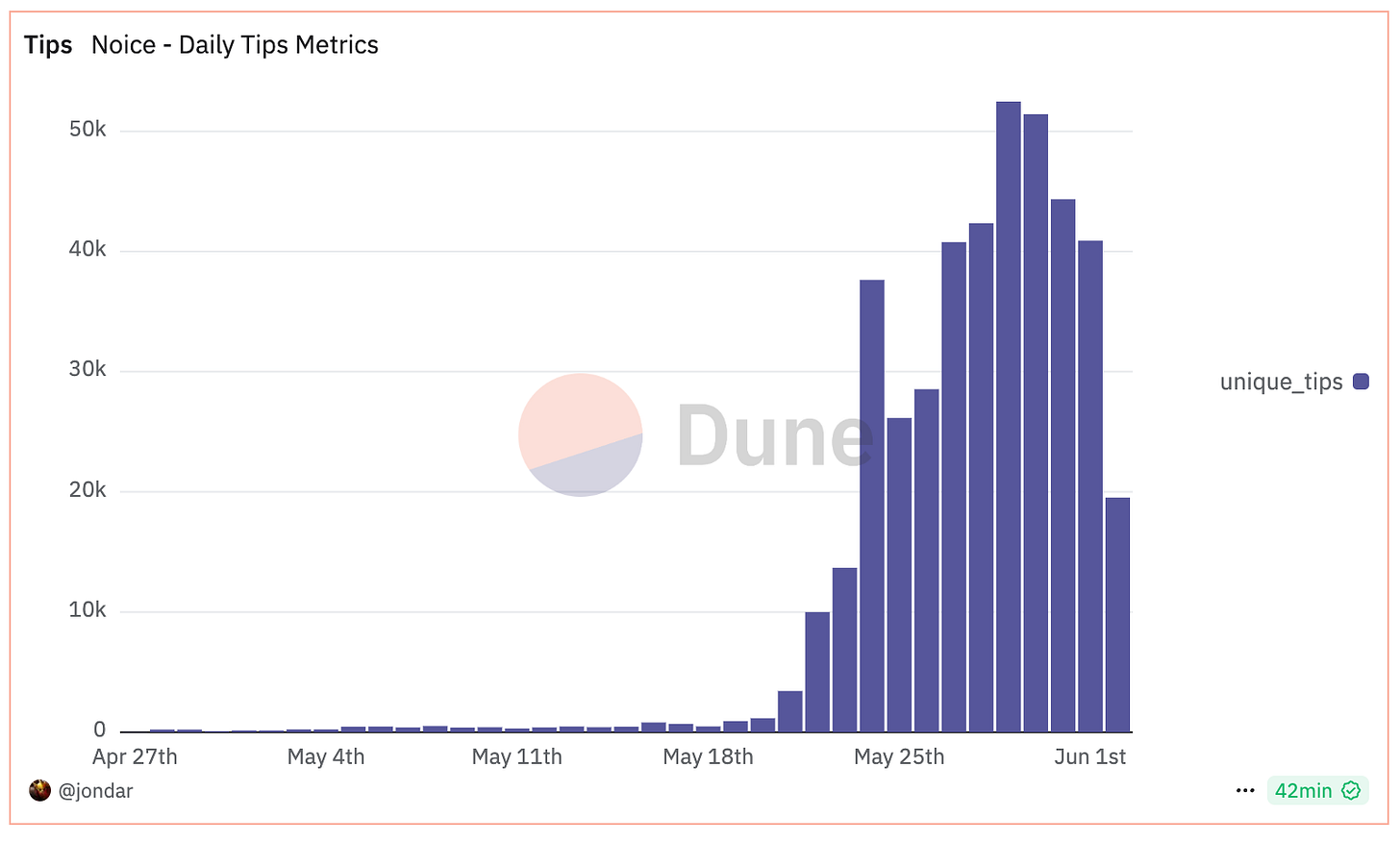

Data Visualization of the Week

Noice launched on May 21 to monetize Farcaster social interactions, generating over 281K tips worth $22.9K from 2,886 wallets to 14K+ recipients in just 10 days, with a 90% user return rate despite $0.08 average tips, as the platform enables USDC/token payments for likes, replies, follows, and premium access like DMs and calls.

Source: Dune - @Jondar

Looking Ahead

The current correction phase introduces uncertainty regarding whether Bitcoin will consolidate or continue its decline. However, the resilient market structure, characterized by stable stablecoin growth and steady DEX volumes, suggests that underlying strength remains intact. The varied performance among altcoins (a broad decline of 6.21% versus select outperformers) indicates the market is entering a more discerning phase, potentially rewarding substance over narrative.

In my next write-up, I plan to explore tools that bridge the gap between off-chain and on-chain analytics. I'm excited to delve into how these emerging platforms are transforming our interpretation of market signals and project fundamentals in near real-time.

Until next Tuesday, Vincent Charles

Did a friend forward this to you? Subscribe here to receive The Signal directly.